AVS takeover and tax returns

AVS stands for Amazon VAT Services, which performs VAT registration and VAT returns for sellers on Amazon.

Tax returns are easily linked to Amazon data through tax reporting on the tool.

Advantages

Advantages

- Holding a VAT number allows you to do business locally.

- You can use it for cross-border e-commerce (Amazon FBA, Shopify, etc.), digital sales, or regular B2B business.

- Holding a VAT number allows you to deduct import tax.

- It can be used for triangular transactions within the EU by simplifying triangular transactions, etc.

constraint

constraint

- Once you have a VAT number, you are obligated to file periodic VAT returns and pay taxes.

- It is assumed to be used in one country.

Companies using our services

Companies using our services

- Companies considering cross-border EC for the EU

- Companies using Shopify or WooCommerce

- B2B businesses such as manufacturers and pharmaceutical companies

- IT companies such as digital goods retailers

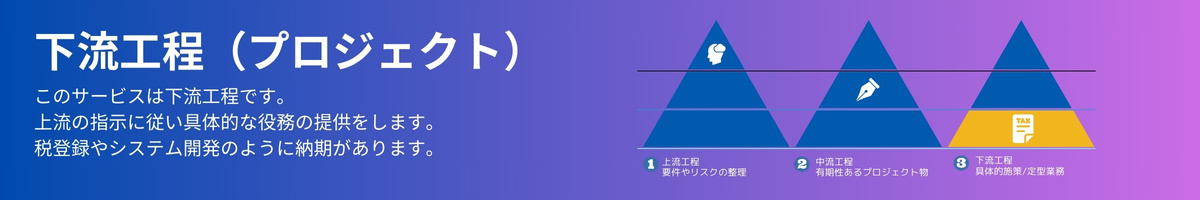

SECTION TEXT - TITLE

AVS takeover flow

The AVS takeover process is as follows

Tax returns will be filed in conjunction with Amazon.

We will get you to the goal in the shortest possible time.

Obtaining a VAT number is like taking a college entrance exam or applying for a grant: it takes time, effort, and know-how to get a VAT number. The reason for this is that the EU authorities have a huge annual VAT gap due to VAT fraud, making it more and more difficult to obtain a VAT number every year. With our 14 years of experience, we can help you get a VAT number in the shortest possible time.

Preparation for VAT registration with high adoption rate

We have provided VAT registration services to many companies since our establishment. We are proud to say that we are probably the most experienced company in Japan. For this reason, we are often asked to handle cases in which a company has failed in VAT registration in the past and has been transferred from another company.

In such cases, we often receive the following questions from many companies.

- How long does it take to get a VAT number?

- Can you handle the entire VAT registration process?

- Can I get a VAT number even though I cannot submit the requested documents?

We understand these questions to a certain extent, but the reality is that it is quite difficult to obtain a VAT number. This makes it difficult to obtain a VAT number easily.

For this reason, if you aim to obtain a VAT number on the targeted date, you should submit your documents as early as possible. Additionally, if you believe that your company does not have enough credit, you should submit as many documents as possible in English or Japanese.

With our 14 years of experience and knowledge of the issues that Japanese companies face, we have the know-how to submit documents that are highly likely to be accepted in each country. On the other hand, there are companies that are not able to prepare the documents, and there are companies that do not want to understand even after we explain the same thing to them over and over again.

We need to understand that VAT registration is not a right for everyone, but a number that must be applied for, adopted, and passed in order to move forward.

If you do not have a tax number, you cannot proceed with your business beyond that point. It is also impossible to request the tax authorities to increase the adoption rate or speed up the application process. Therefore, we would like to raise your awareness and work with you to achieve early VAT registration.

VAT Declaration Process

The VAT declaration process is as follows

The tax return is submitted to the tax authorities. At the same time, please pay the tax amount.

You can check the details of your declaration in MyOpti.We will store your tax returns at our company.

Storage periods vary by contract.TABLE OF CONTENTS

From advice to filing and tax payment

From advice to filing and tax payment

- We offer a full range of services from the preparation of opinion letters to tax returns.

- We can advise you on applicable tax laws and case law, as well as the latest electronic invoice taxation system.

- We prevent tax registration in the wrong area.

- Based on the results of the opinion letter, we also carry out tax registration and tax filing, and handle tax payments.

More than 70 countries covered

More than 70 countries covered

- We can handle tax registrations and tax returns in 70 countries, including the EU, UK, UAE, Russia, North America, Canada, Korea, China, and India.

- In our advisory services, we have partnered with one of the world's largest global tax firms and can advise in more than 140 countries worldwide.

- We are ready to support your business in a comprehensive manner.

Knowledge of cross-border EC and IT

Knowledge of cross-border EC and IT

- We have been dealing exclusively with this field since 13 years ago, when the term "cross-border EC" was in its infancy.

- We have not only tax information, but also a lot of related cross-border EC information. We also work with companies in the cross-border EC area to create value.

- We can provide a consistent service by using MyOpti, which specializes in cross-border EC tax reporting.